The Ultimate Guide to Efficient Bookkeeping for Small Businesses

Bookkeeping is the backbone of any successful small business. It involves recording and organizing financial transactions, which is essential for making informed decisions, maintaining compliance with tax laws, and ensuring the financial health of your business. Whether you’re just starting or looking to improve your bookkeeping practices, this guide will help you streamline your processes […]

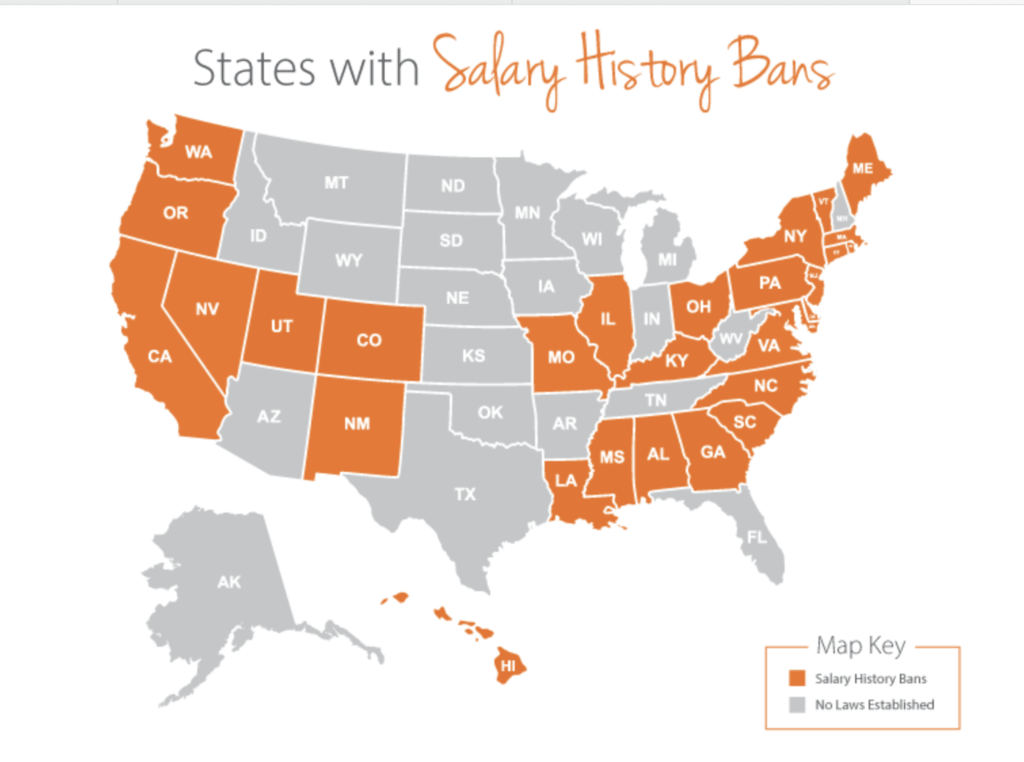

SALARY HISTORY BANS

In Massachusetts where we are headquartered, all employers are banned from asking for salary history information. They can, however, confirm prior history if volunteered by the applicant or if an offer has been extended. However, if known, previous pay cannot be a defense to a pay discrimination claim. Currently, 21 other states have similar statewide […]

Determining the Best Accounting System for Your Business

Selecting the right accounting system is crucial for maintaining financial health and operational efficiency. Here are the essential steps to identify and implement the best accounting system for your business: 1. Assess Your Needs and Goals Identify Requirements: Determine the specific features your business needs, such as payroll, invoicing, inventory management, scalability, and integration with […]

Lets get that loan and what to consider

When banks evaluate a small business loan application, they typically consider several key factors to assess the creditworthiness and financial health of the business. Here are the primary criteria banks look for: 1. Credit History: o Personal and Business Credit Scores: Banks will review the credit scores of the business owner(s) and the business itself. […]

5 Steps To Boost Client Retention

In 2022, the number of accountants and financial professionals working in the US reached a record high. With increased competition, retaining your existing clients has become more crucial than ever. To help you navigate this competitive landscape, we share five essential steps professionals can take to foster long-term relationships and keep their customers happy and […]

Boosting Small Business Growth: Why SBA Loan Limits Must Rise in Today’s Economy

In today’s economy, the purchasing power of $5 million is not what it once was, with rising costs across housing, fuel, food, and labor sectors. The SBA (7a) loan limit, static since its last increase to $5 million in 2010, struggles to meet modern small business needs. With the SBA backing up to 85% of […]

Beyond the Finish Line: The Impact and History of the Boston Marathon 2024

The Boston Marathon started on Monday, April 19, 1897. The Olympics and a famous Greek legend inspired it. Millions of people have run the Boston Marathon. They face multiple challenges qualifying and then training, heat, exhaustion, heartbreak hill and then the 2 hours and 3 minutes if your Kenyan Geoffrey Mutai in 2011 or 4 […]

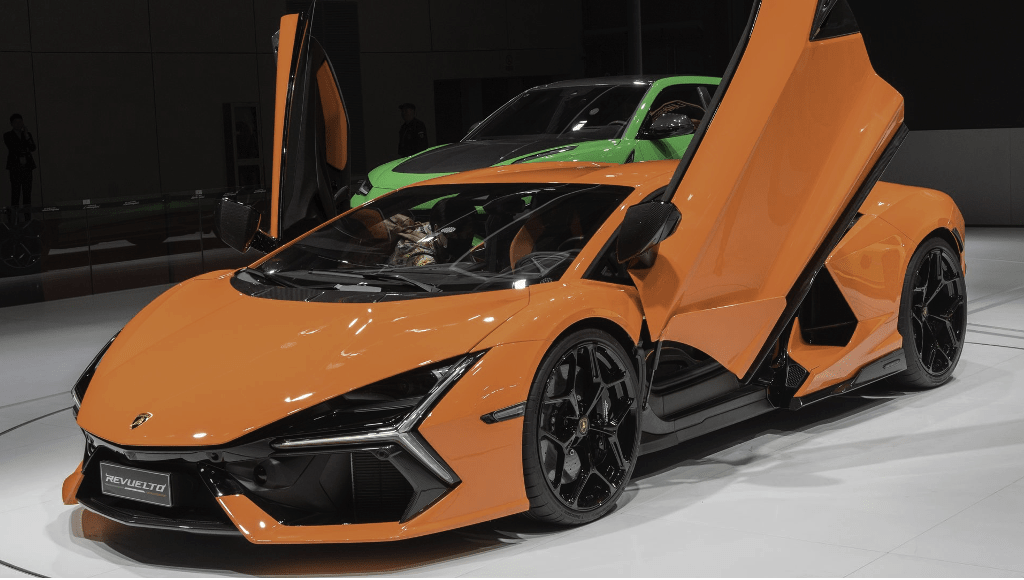

Electric Dreams Versus Hybrid Realities: Navigating the Future of Driving with the 2024 Lamborghini Revuelto

2024 Lamborghini Revuelto V12 plug in hybrid $608,000. Is an all-electric EV vehicle in your future? If you watched the Super Bowl this year, ads for EVs dominated the commercials. Early adopters with $100,000 or more flocked to the all-electric Tesla vehicles, but sales have cooled on EVs, and manufacturers have had to cut production […]

How to Reduce Business Debt Effectively

Effective debt management for business owners involves several key strategies: 1. Assessment and Planning: Start by assessing your current debt situation. Understand the types of debt you have, the interest rates, repayment terms, and monthly obligations. Develop a comprehensive debt repayment plan that aligns with your business’s cash flow and financial goals. 2. Budgeting and […]

Navigating Tax Season 2024: Deductions, Deadlines, and Donations

Traveling for Business in 2024? What’s Deductible? If you and your employees will be traveling for business this year, there are many factors to keep in mind. Under the tax law, certain requirements for out-of-town business travel within the United States must be met before you can claim a deduction. The rules apply if the […]